- Nearly 1.6 million Californians have renewed their coverage or enrolled for the first time for 2021 coverage, setting a new enrollment record in the midst of the worst COVID-19 spike since the beginning of the pandemic.

- The record enrollment total is 200,000 higher than the same time period last year, with significant portions of low-income consumers and communities of color, which are among the groups hardest hit by the COVID-19 pandemic.

- With a dramatic increase in post-holiday COVID-19 cases, Covered California and other state health leaders continue to encourage people to take precautions: wear a mask, wash your hands, watch your distance, stay home when you can, and get covered with a quality health insurance plan.

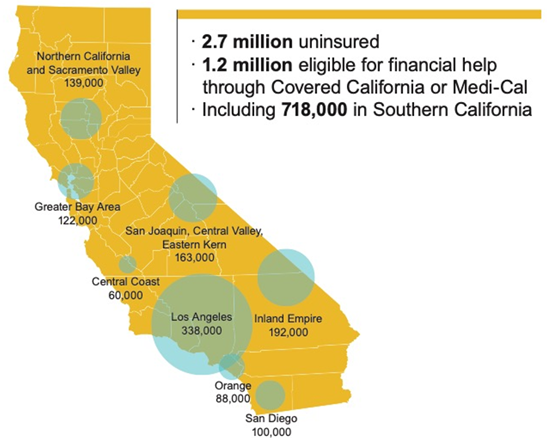

- Covered California’s open-enrollment period runs through Jan. 31, and of the 2.7 million Californians who are uninsured, an estimated 1.2 million are eligible for financial help from Covered California or through Medi-Cal.

SACRAMENTO, Calif. — Covered California announced on Tuesday that it has begun the New Year with a record number of people who have signed up for coverage amid a severe spike in COVID-19 cases across the state. A record 1.6 million Californians had either renewed their coverage or selected a plan during open enrollment for health insurance coverage starting Jan. 1, 2021. The total represents an increase of almost 200,000 (14 percent) over the same time period last year.

“With the pandemic continuing to surge across the state, now is not the time to be uninsured,” said Peter V. Lee, executive director of Covered California. “We are in the

(more)

midst of a post-holiday surge, and we want to encourage anyone who needs health care coverage to check out their options and sign up so they can get covered in 2021.”

More than 2.7 million Californians have been infected by the virus, and the death total is expected to surpass 30,000 today.

“While collectively we are all hands are on deck to distribute vaccines across the state, we cannot let our guard down during this rise in cases and hospitalizations because the ability to transmit the virus from one person to another is so high right now,” said Dr. Mark Ghaly, the California Health and Human Services secretary and chair of the Covered California Board of Directors. “We all need to do our part to defeat this pandemic, and that means wearing a mask, staying home and getting covered with a quality health insurance plan.”

Right now, of the 2.7 million Californians who are uninsured, an estimated 1.2 million are eligible for financial help through Covered California, or they qualify for low-cost or no-cost coverage through Medi-Cal. The largest portion of these uninsured who are eligible for help are in Southern California, with an estimated 718,000 people eligible for financial help in the Los Angeles, Inland Empire, Orange and San Diego metro areas (see Figure 1: Where California’s Uninsured Who Are Eligible for Financial Help Live).

Figure 1: Where California’s Uninsured Who Are Eligible for Financial Help Live

“Most of the people who are uninsured who can get help do not know they are eligible for financial assistance, or they have not checked recently to see how affordable quality coverage can be,” Lee said. “No one should wait to sign up. Enroll now and tell your family and friends so we can make sure everyone possible has health insurance during this pandemic.”

The most recent data shows that 1.4 million people, or nearly 90 percent of Covered California’s enrollees, are receiving some level of financial help that lowers the cost of their monthly premium by an average of nearly 80 percent.

Of those receiving financial help, almost half — over 640,000 — are benefiting from the state subsidy program launched in 2020 to make coverage more affordable, including 44,500 middle-income consumers who were previously ineligible for assistance because they exceeded the federal income requirements.

Record Plan Selections

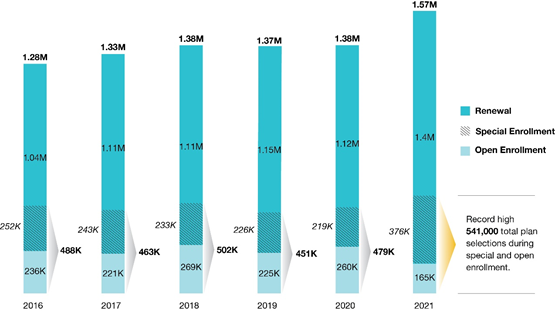

The record number of consumers signing up for a plan comes after Covered California opened a special-enrollment period throughout the spring and summer and signed up hundreds of thousands of people who either did not have health insurance or lost their coverage due to the pandemic and recession. With this outreach, the total of those going into 2021 with coverage purchased during special enrollment in 2020 and those newly signing up during the current open-enrollment period totaled 541,000 — the largest figure for new sign-ups since the end of a preceding open-enrollment period in Covered California’s history (see Figure 2. Plan Selections for Coverage Years 2016 to 2021).

Figure 2. Plan Selections for Coverage Years 2016 to 2021[i][1]

While the number of plan selections — both overall and in the combined special enrollment and open-enrollment periods — is at a historic high, the new enrollment seen during the current open-enrollment period is down from the all-time high Covered California saw during this time last year. The biggest likely contributor to that change is that fact that many of those, who in prior years would have signed up during open enrollment, got coverage earlier during the special-enrollment period.

“When the pandemic began to hit California hard in the spring, Covered California opened its doors to every eligible consumer because it was the right thing to do,” Lee said. “This is a year like no other, but we are seeing Covered California meet the needs of those hardest hit by the COVID pandemic — including communities of color and lower-income Californians.”

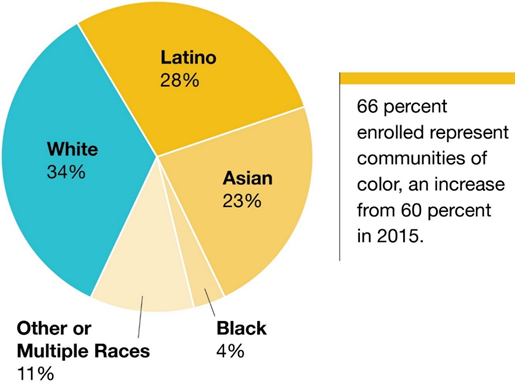

Over the past six years, Covered California has seen a steady increase in the diversity of its new consumers who sign up during special and open enrollment. The data shows that nearly two-thirds (66 percent) are from communities of color, which represents an increase from 60 percent in 2015 (see Figure 3. Special and Open-Enrollment Plan Selections by Ethnicity).

Figure 3. Special and Open-Enrollment Plan Selections by Ethnicity[2]

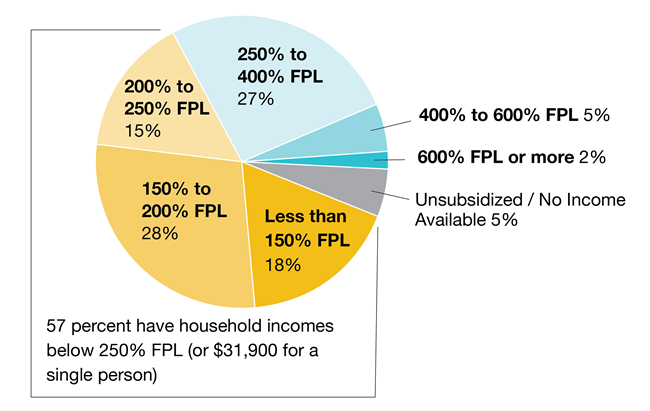

The data also highlights Covered California’s critical role in helping low-income Californians — those hardest hit by the COVID pandemic — get access to necessary health care. Of the record number of plan selections, 57 percent of consumers have an annual household income of less than 250 percent of the federal poverty limit (FPL), which corresponds to just under $32,000 for a single person household (see Figure 4. Covered California 2021 Net Plan Selections by Income).

“These are Californians who are most vulnerable to the pandemic, many of them working hourly jobs or in the service industry, who have been hardest hit by the crisis,” Lee said. “Covered California helps give them access to some of the best care in the country and the peace of mind in knowing that they have insurance to protect them if the worst happens.”

Figure 4. Covered California 2021 Net Plan Selections by Income Additionally, 44,500 middle-income Californians now benefit from the state subsidy program, which is the first in the nation providing financial assistance to consumers whose income exceeds the federal requirements. Under the landmark program, Californians earning up to $76,560 — or a family of four with a household income of up to $157,200 — may be eligible for financial help to lower the cost of their coverage.

(more)

Shop and Compare

Those interested in applying for coverage can explore their options — and find out whether they are eligible for financial help — in just a few minutes by using the Shop and Compare Tool at CoveredCA.com. All they need to do is enter their ZIP code, household income and the ages of those who need coverage to find out which plans are available in their area.

Consumers who sign up by Jan. 31 will need to pay their first bill in order to have their coverage take effect on Feb. 1.

“Now is not the time to be sick and uninsured as California continues to endure the worst pandemic in modern history,” Lee said. “Don’t put yourself or your family at risk. Sign up now and be covered on Feb. 1.”

Lee added that, in light of the pandemic, Covered California will continue to evaluate what the agency may do after the Jan. 31 deadline if further action is needed to help Californians during this critical time.

Another important reason to sign up is that California’s individual mandate penalty remains in place for 2021. Consumers who can afford health care coverage, but choose to go without, could pay a penalty when filing their state income taxes in 2022. The penalty is administered by California’s Franchise Tax Board, and could be as much as $2,250 for a family of four.

Getting Help Enrolling

Consumers interested in learning more about their coverage options can:

- Visit www.CoveredCA.com.

- Get free and confidential in-person assistance, in a variety of languages, from a certified enroller.

- Have a certified enroller call them and help them for free.

- Call Covered California at (800) 300-1506.

About Covered California

Covered California is the state’s health insurance marketplace, where Californians can find affordable, high-quality insurance from top insurance companies. Covered California is the only place where individuals who qualify can get financial assistance on a sliding scale to reduce premium costs. Consumers can then compare health insurance plans and choose the plan that works best for their health needs and budget. Depending on their income, some consumers may qualify for the low-cost or no-cost Medi-Cal program.

Covered California is an independent part of the state government whose job is to make the health insurance marketplace work for California’s consumers. It is overseen by a five-member board appointed by the governor and the Legislature. For more information about Covered California, please visit www.CoveredCA.com.

[1] “Special Enrollment” is a subset of the renewal population. For example, of the 1.4 million renewing consumers for 2021, 376,000 had newly signed up during the special-enrollment period during 2020.

[2] All plan selections since the end of 2020 open enrollment through Dec. 31, 2020, including new enrollments during both 2020 special enrollment and 2021 open enrollment.

[i] Data through Dec. 31, 2020. Renewal data for 2021 reflect net plan selections as of this release. The final count of renewal plan selections reported at end of the open-enrollment period may be slightly lower due to lags in carrier transactions; based on 2020 plan year data patterns, the final number of net renewals may decrease an estimated 1.0 and 1.5 percent of renewals, or ~25,000 consumers from what is seen as of Dec. 31, 2020. Open enrollment began on Oct. 15 for the 2020 coverage year and Nov. 1 for 2021.

Crossings TV Asian Television – Home to Asian Americans

Crossings TV Asian Television – Home to Asian Americans