- The virtual tour will reach into media markets across California to promote open enrollment and the increased financial help that is now available, which is lowering the cost of coverage for more people than ever before.

- An estimated 1.1 million Californians are uninsured and eligible for financial help, with the vast majority able to get coverage at no cost through either Covered California or Medi-Cal.

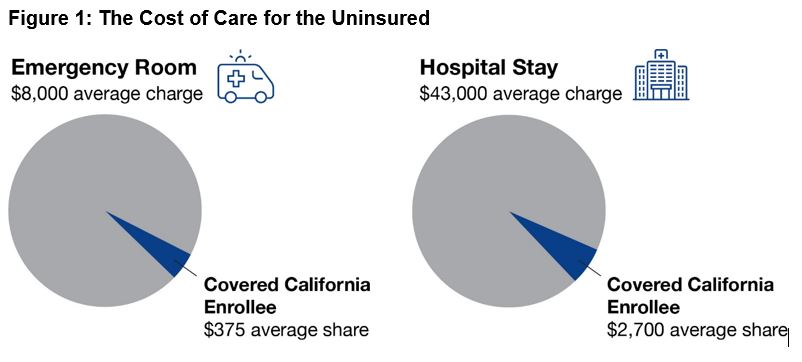

- New data from Covered California shows how much protection and peace of mind insurance provides, with the uninsured facing staggering out-of-pocket costs if they visit an emergency room or are admitted into a hospital.

- People who want their coverage to start on Jan. 1, 2022, must sign up by Dec. 31, 2021. Covered California’s open-enrollment period runs through Jan. 31, 2022.

SACRAMENTO, Calif. — Covered California launched a statewide virtual “Coverage Matters” tour on Tuesday to promote open enrollment and the financial protection it provides Californians who visit the emergency room or are admitted to a hospital in the event of an illness or injury. In addition, the tour will highlight the unprecedented financial help that is lowering the cost of health insurance for more people than ever before.

“Coverage matters, and the data shows just how much financial protection Covered California’s comprehensive plans are providing,” said Peter V. Lee, executive director of Covered California.

“New coverage options give many Chinese Americans access to quality care that can help them stay out of the emergency room or hospital — and if you do end up needing care, this newly affordable health insurance can protect you and your family from medical bills that can be staggering.”

Data Shows How Consumers Save During Emergency Room and Hospital Visits

Recent claims data from Covered California enrollees during 2019 and 2020 shows that about one out of ten enrollees visit the emergency room each year and the average overall hospital charge for those visits is $8,000. However, the coverage through Covered California paid for more than 95 percent of those costs, with $375 being the average out-of-pocket cost for their visit.

Similarly, while fewer than 3 percent of Covered California enrollees were admitted to the hospital, the average overall charge for the admission was $43,000, but of those costs, insurance picked up well over 90 percent — leaving enrollees responsible for an average out-of-pocket cost of just $2,700.

“No one wants to end up in an emergency room or hospital, but if you do, a quality health insurance plan through Covered California can save you tens of thousands of dollars,” Lee said. “In addition, having health insurance means you are more likely to get preventive care and regular treatment for chronic conditions, which helps keep you out of the hospital in the first place.”

A recent study by the Kaiser Family Foundation found that more than two out of every five uninsured adults (42 percent) reported that they had not seen a doctor or health care professional in the last 12 months, and 41 percent said they do not have a usual source of care when they are sick or need medical advice. The study also found that nearly one out of every three uninsured either postponed care (32 percent) or went without care (30 percent) because of cost.

“Regardless of where you live, how much you make, what language you speak or what community you’re from, Covered California wants you to get the care you need to stay healthy,” said Dr. Alice Hm Chen, chief medical officer of Covered California. “Covered California plans provide access to some of the best doctors and hospitals across the state and include coverage for both physical and mental health care.”

More Financial Help Available to More People Than Ever Before

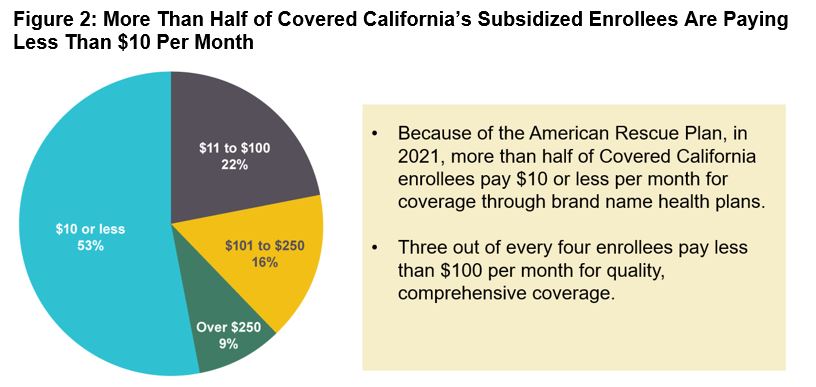

Enrolling in quality coverage is more affordable — for more people — than ever before thanks to the increased subsidies provided under the American Rescue Plan, the federal law that took effect in 2021.

An estimated 1.1 million Californians are uninsured and eligible for financial help. The vast majority of the uninsured, more than 940,000 people, can get coverage through Covered California or Medi-Cal at no cost.

Californians who do not qualify for a $0 premium will still likely see significant savings through the increased financial help available. Right now, more than half of Covered California enrollees are paying less than $10 per month, and 75 percent are paying less than $100 for their brand-name health plan.

In addition, the American Rescue Plan provides financial help to many families earning more than $106,000 a year. These middle-income families, who were previously ineligible for federal assistance, are now saving an average of nearly $800 a month on their health insurance premiums.

(more)

The new financial help for middle-income consumers can also benefit those who are currently insured directly through a health insurance company. An estimated 260,000 Californians have direct coverage — also known as “off-exchange” coverage. They can sign up through Covered California and potentially get the same plan they have off-exchange, or shop for other coverage that best fits their needs, and save hundreds of dollars per month.

“Whether you are insured on your own, or you do not have any coverage at all right now, the message is the same: Now is the time to check your eligibility and options,” Lee said. “In just a few minutes you can easily find out how much financial help you can receive, and the coverage options in your area, by visiting CoveredCA.com.”

Free and Confidential Help From Local Enrollers

In addition to signing up consumers through their own through the website, Covered California also partners with certified and licensed enrollers who provide free and confidential help throughout the state. Covered California works with more than 11,000 Licensed Insurance Agents, who have established more than 500 storefronts in communities across California.

These storefronts feature Covered California signs and logos and provide consumers with a local point of contact to answer questions and help people enroll in a health insurance plan that best fits their needs, whether through Covered California or Medi-Cal, depending on their eligibility.

Consumers can visit https://www.coveredca.com/support/contact-us/ and search for the agent or storefront nearest them.

Nearly three out of every five of Covered California’s agents (57 percent) speak more than one language, which helps them assist Covered California’s diverse population where two out of every three enrollees represent a community of color. Overall, Covered California’s agents speak more than 40 languages.

Upcoming Deadline for Jan. 1 Coverage

Covered California’s open-enrollment period runs through Jan. 31, 2022 and those who want their coverage to start on Jan. 1 need to sign up by Dec. 31. Interested consumers can do the following to sign up for coverage:

- Visit CoveredCA.com/chinese to learn about coverage options and enroll online.

- Find a local agent or other certified enroller on the website and get help for free.

- Call Covered California at (800) 300-1533 (Mandarin) or (800) 339-8938 (Cantonese) and get information or enroll by phone.

Covered California’s online enrollment portal and certified enrollers will help people find out whether they are eligible for Medi-Cal or Covered California. Medi-Cal enrollment is available year-round, and the coverage will begin the day after a person signs up.

About Covered California

Covered California is the state’s health insurance marketplace, where Californians can find affordable, high-quality insurance from top insurance companies. Covered California is the only place where individuals who qualify can get financial assistance on a sliding scale to reduce premium costs. Consumers can then compare health insurance plans and choose the plan that works best for their health needs and budget. Depending on their income, some consumers may qualify for the low-cost or no-cost Medi-Cal program.

Covered California is an independent part of the state government whose job is to make the health insurance marketplace work for California’s consumers. It is overseen by a five-member board appointed by the governor and the Legislature. For more information about Covered California, please visit www.CoveredCA.com.

###

Crossings TV Asian Television – Home to Asian Americans

Crossings TV Asian Television – Home to Asian Americans